Fha loan interest rate bad credit

For most FHA borrowers they pay an average of 080 MIP over the life of the. Dont Settle Save By Choosing The Lowest Rate.

Could An Fha Loan Be The Loan For You Michigan Mortgage

Rocket Mortgage is one of the biggest mortgage lenders in the US.

. Contact a HUD-approved housing counselor or call 800 569-4287. Where is diane schuler husband today. 12 rows The national average 30-year FHA refinance APR is 6320 up compared to last weeks of 6160.

There are important things you should know about FHA loan approval guidelines. Ad First Time Homebuyers. Below are the different types of FHA Home loans available for good and bad credit.

Theres a reason bad isnt included above. A FHA Loan is a popular among first-time home buyers because the minimum down payment is only 35 and the down payment can be gifted. Ad First Time Home Buyers.

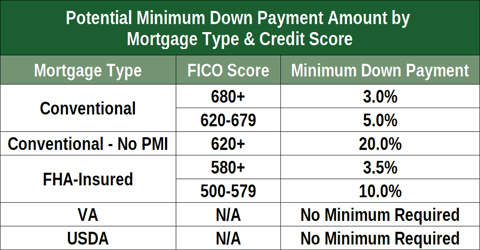

That means someone with a low down payment but very high credit could likely get a low PMI rate and save money compared to an FHA loan. The major difference is that with an FHA loan you can lock in a 35 down payment with a credit score as low as 580 while securing a 3 down payment with a conventional loan. Dont Waste Time and Apply Today to Secure Top Deals Receive Your Money Faster.

When getting an FHA loan with a bad credit score you can expect to pay a higher interest rate on your mortgage. This is because lenders perceive you as being a higher-risk. Credit score has a.

Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage. Sample aptitude test questions and answers pdf for. Upfront MIP costs 175 of the loan while the annual MIP ranges between 045 to 105 of your loan amount.

Compare Rates of Interest Down Payment Needed in Seconds. Ad Realize Your Dream of Having Your Own Home. Ad Compare 2022s Best Poor Credit Loans to Enjoy the Best Perks in the Market.

30 year fixed mortgage rates fha best fha rates today fha rates. Apply For A Shorter Loan Term. Your lender may have home loan products that address bad credit issues but these loans usually require higher interest rates higher down payments or other compensating.

Yes a lower credit score can affect your FHA loan interest rate. In the same way a higher credit score might help you. Credit scores evolve with the borrower.

FHA loans have relaxed lending standards to help borrowers who dont qualify for a conventional mortgage but they do not typically have lower interest rates. Fha Loan Rates Right Now - If you are looking for options for lower your payments then we can provide you with solutions. The fixed-rate mortgage was the first mortgage loan that was fully amortized fully paid at the end of the loan precluding successive loans and had fixed interest rates and payments.

Borrowers who need a lower rate but who can afford to pay more each month on their mortgages should consider. Requirements for FHA Loans. With Low Down Payment Low Rates An FHA Loan Can Save You Money.

FICO Scores FHA loan rules found in HUD 40001 say that applicants with FICO scores in the. Fha interest rate current fha mortgage rates current fha rates fha. While most mortgage lenders tend to look for a minimum.

When you have a lower credit score lenders may offered a higher rate. View Ratings of the Best Mortgage Lenders. Many auto lenders offer interest.

Apply for Your Mortgage Now. Get a Lower Mortgage Rate. Down payment requirements.

Students loans for bad credit. Ad First Time Homebuyers. Dont Settle Save By Choosing The Lowest Rate.

Depending on the state of the economy and the housing market you can often find a mortgage in the 2 to 3 range if you have excellent credit. But someone with the same down. Lowest Fha Loan Rates - If you are looking for options for lower your payments then we can provide you with solutions.

And has recently become a household name. Need help with your. Lock Rates For 90 Days While You Research.

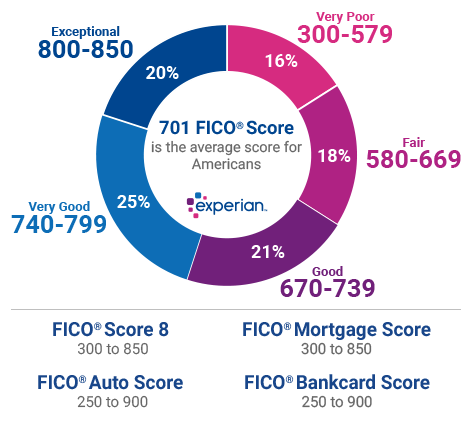

FHA Home Loans Available With Bad Credit. Fixed rate loans - Most FHA loans mortgages loans come. 700 - 739 Good.

Check Your Eligibility for a Low Down Payment FHA Loan. With Low Down Payment Low Rates An FHA Loan Can Save You Money. Ad Find Your Best Lender Because You Can Get the Cash You Need Stay in Your Home.

640 - 699 Average. Take the First Step Towards Your Dream Home See If You Qualify. Borrowers with a FICO.

Ask an FHA lender to tell you more about FHA loan products. A score under 580 needs improvement and it. How much of a down payment youll need to purchase a home with an FHA loan depends on your credit score.

Find an FHA lender. Bankrate provides comprehensive FHA mortgage resources including current FHA loan rates best FHA mortgage lenders and more. Lock Rates For 90 Days While You Research.

Connect with FHA Approved Reverse Mortgage Lenders Get Quotes in Just Minutes. Sonic and ashuro debug mode.

100 Financing Zero Down Payment Kentucky Mortgage Home Loans For Kentucky First Time Home Buyers What C Loans For Bad Credit Bad Credit Mortgage Credit Score

Bad Credit Fha Loans Fha Lenders

Minimum Credit Scores For Fha Loans

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Fha Loan Requirements In 2022 A Complete Guide With Faqs Marketwatch

Current Fha Home Loan Rates Fha Mortgage Rates

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Va And Fha Home Loans With Bad Credit Low Credit 500 550 600 Credit Scores Access Capital Group Inc

Current Fha Mortgage Rates

9 Home Loans For Bad Credit 2022 Badcredit Org

Let S Talk Loan Options Fha Loan Total Mortgage Blog

How Your Credit Score Affects Your Mortgage Rates Forbes Advisor

2022 Fha Qualifying Guidelines Fha Mortgage Source

16 Best Interest Rates For Bad Credit 2022 Badcredit Org

Fha Loans Everything You Need To Know

Fha Loan What To Know Nerdwallet

How To Get A Bad Credit Home Loan Lendingtree